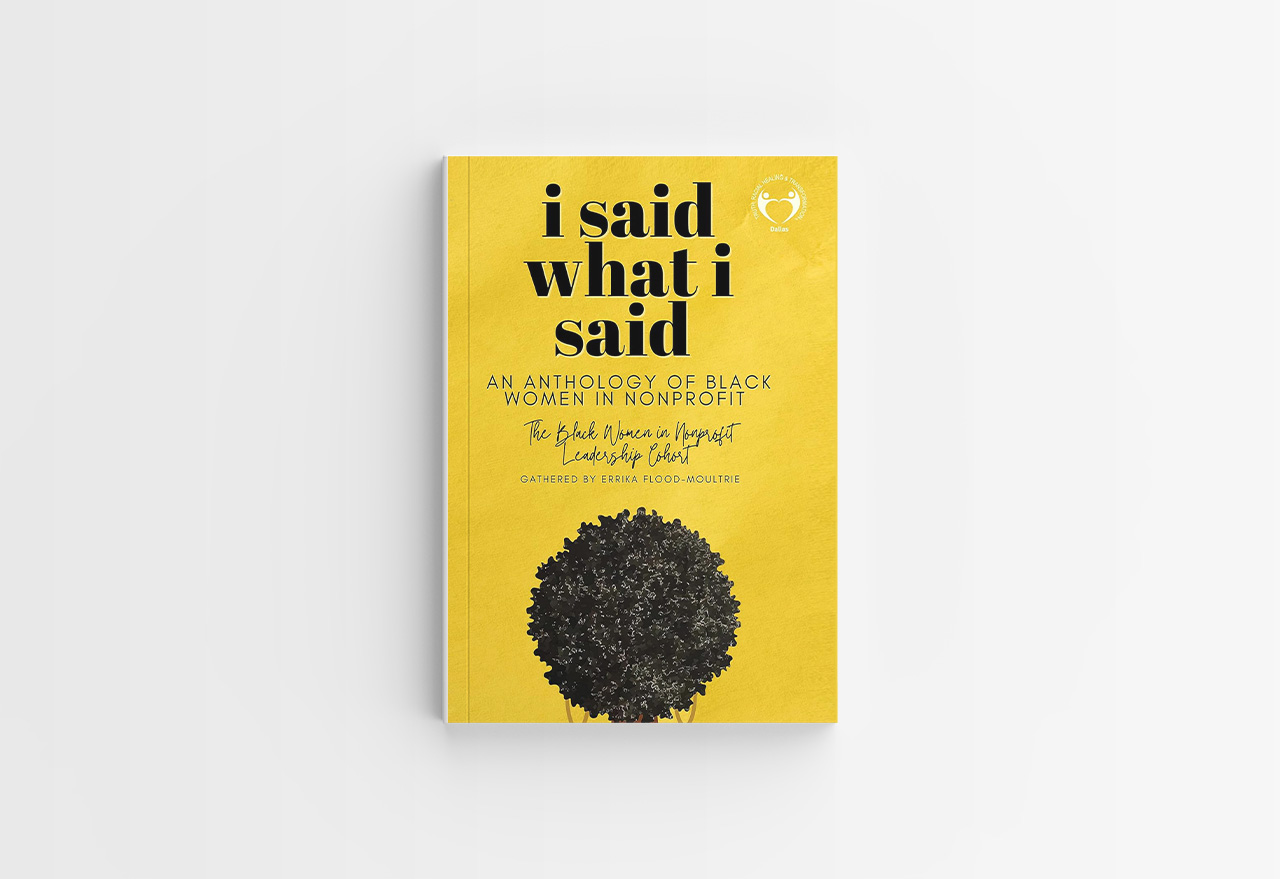

BETTER IMPACT BOOK BITES: I Said What I Said: An Anthology of Black Women in Nonprofit

This Month's SelectionI Said What I Said: An Anthology of Black Women in Nonprofit Authored by: Errika Y. Flood-MoultrieThe eleventh in a series of...

3 min read

William Henry, Vice President, Volunteers Insurance Service Association, Inc.

Mar 13, 2024 8:30:00 AM

William Henry, Vice President, Volunteers Insurance Service Association, Inc.

Mar 13, 2024 8:30:00 AM

Insurance isn't just a financial safeguard for nonprofit organizations; it's a strategic imperative. From protecting assets to mitigating unforeseen liabilities, the role of insurance is pivotal in ensuring the sustained resilience and success of organizations committed to making a difference.

For nonprofits, there are insurance coverages that are nice-to-have and coverages that a responsible organization must have, to protect itself and its volunteers.

Let’s dive into what some of these insurance coverages are, as provided by Volunteers Insurance Service Association, Inc. (VIS).

Your directors and officers can be sued for a variety of “wrongful acts,” or mismanagement of the organization or its resources. Without “D&O” insurance in place, your directors and officers could lose their homes and businesses trying to pay legal expenses. You need to protect your directors and officers, so they aren’t putting their assets at risk.

The most common limit is $1,000,000 for a small to average size organization, but higher limits are available. The directors and officers liability policy available through Volunteers Insurance Service Association (VIS) has a minimum premium of $800 for a $1 million limit of liability.

No matter how safety-conscious your staff and volunteers are, accidents happen. If you have an office, people can be injured on your premises. General liability coverage protects the organization and its employees against allegations of bodily injury, property damage and “personal injury” such as libel or slander. General liability can also protect your volunteers, but that means your liability limit is shared unnecessarily with volunteers. We recommend purchasing a general liability policy with a limit of liability not less than $1,000,000 per occurrence and $2,000,000 aggregate for the organization itself, and a separate policy to cover volunteer liability. The minimum premium for general liability is around $800; the minimum for volunteer liability through the VIS program is $100.

General liability policies don’t cover property damage or bodily injury caused by vehicles. If your organization doesn’t own vehicles, you can obtain “hired and non-owned” auto coverage. Hired would be a rental car. Non-owned would be the vehicles of your employees or volunteers when used in their assignments. This can be a separate policy, or it can be added to your general liability policy. We recommend a limit of not less than $1,000,000. The minimum premium is about $250.

This coverage protects the organization. However, volunteers often are concerned about their own liability. Offering volunteer excess auto liability coverage can satisfy those concerns. This coverage sits over the volunteer’s personal auto liability coverage. The minimum premium through the VIS program is $100.

If you have employees, your state probably requires that you carry workers’ compensation insurance, for job-related injuries. Sometimes volunteers can be covered under workers compensation, but even if your state will allow it, we recommend you cover them separately. Volunteer accident coverage pays in excess of your volunteers’ other insurance (if any) and is much less expensive than workers’ compensation. Workers’ compensation premiums vary according to total payroll and loss experience. The minimum premium for volunteer accident insurance with VIS is $100.

If you have employees, risks include failure to hire or promote, wrongful termination, sexual harassment, discrimination, and more. For nonprofits, the coverage can be endorsed onto a directors and officers liability policy for about $200.

Because every organization’s needs are a little different, it’s important that you work with an agent or broker who understands nonprofit organizations and can place coverage with appropriate insurance companies. Unfortunately, most agents (and companies, for that matter) do not specialize in nonprofits. If you need help identifying an agent who’s an exception, please contact VIS.

If you own or lease an office, you will need to cover property such as furniture, computers, phones and equipment. The lease might require it. Property insurance premiums vary based on the value of what is covered.

While we might never think our employees or volunteers would be dishonest, things happen sometimes. Crime coverage makes the organization whole if a theft occurs. Coverage can be limited to the premises or can include losses off premises. You can cover the assets of others, such as clients. The VIS crime policy starts at a little more than $200 and is based upon the number of volunteers and employees.

If you collect personal information, you have a cyber liability exposure. Even though your organization might not be a high-profile target for hackers, information can be released accidentally, or intentionally by a disgruntled employee or volunteer. The more information that you have, the higher your risk. Cyber liability coverage helps pay expenses you would incur should there be a breach. Pricing and coverage vary greatly.

Umbrella coverage provides additional limits, above the scheduled underlying liability limits. The cost per million dollars of coverage is less than for the underlying policies.

In conclusion, the importance of insurance coverage for nonprofit organizations cannot be overstated. It serves as a vital safeguard, protecting these entities from unforeseen challenges, ensuring financial resilience, and allowing them to stay steadfast in their missions. With insurance as a cornerstone, nonprofits can navigate uncertainties with confidence, focusing on what truly matters – making a positive and lasting impact on the communities they serve. It's not just a safety net; it's a strategic investment in the longevity and effectiveness of the altruistic endeavors that shape the heart of nonprofit work.

Featured Posts

This Month's SelectionI Said What I Said: An Anthology of Black Women in Nonprofit Authored by: Errika Y. Flood-MoultrieThe eleventh in a series of...

As pillars of compassion and change, non-profits heavily rely on the dedication of volunteers. However, the responsibility to ensure a safe...

Effective volunteer supervision is crucial for a successful volunteer program and thus greater impact. By leading volunteers well, you can ensure...